wv estate tax return

-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. WV4868 Application for Extension.

Software Systems Inc Property Tax Inquiry

When does the Estate Appear on the West Virginia State Tax Return When a person dies the estate state tax returns would appear on page 19 of the West Virginia State Tax Return.

. Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance. You will be automatically redirected to the home page or you may. Generally the estate tax return is due nine months after the date of death.

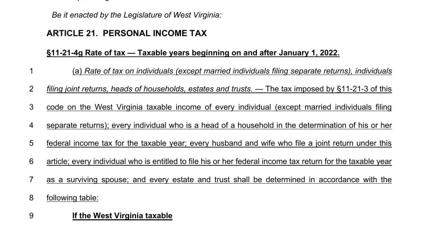

110-CSR-1P Legislative Rule Title 110 Series 1P Valuation of Commercial and Industrial Real and Personal Property for Ad Valorem Property Tax. Estate tax returns. About Form 706 United States Estate and Generation-Skipping Transfer Tax Return.

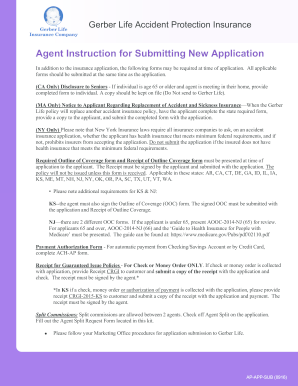

The executor of a decedents estate uses Form 706 to figure the estate tax imposed by Chapter 11. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid. B Returns by personal representative.

-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. Tax Information and Assistance. IT-140NRC West Virginia Nonresident Composite Return.

B Returns by personal representative-- The personal. Tax Information and Assistance. -- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this.

Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the West Virginia Tax Divisions primary mission is to diligently collect and accurately assess taxes. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map. When someone dies their assets become property of their estate.

West Virginia Estate and Inheritance Tax Return Engagement Letter - 706 Get state-specific forms and documents on US Legal Forms the biggest online library of fillable legal templates. West Virginia has neither an estate tax. 304 558-3333 or 800 982-8297.

B Returns by personal representative-- The personal. Property Tax Forms and Publications. -- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article.

Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the West Virginia estate tax. The proper forms and instructions will be sent to the. A When no return required.

For tax year 2021 the due date for an annual. The taxable year of the estate or trust for West Virginia income tax purposes is the same as the one used for federal tax purposes. IT-141 Fiduciary Income Tax Return for Resident and Non-resident Estates and Trusts Instructions.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. File an Estate Tax Income Tax Return Assets that Generate Income to an Estate. Your session has expired.

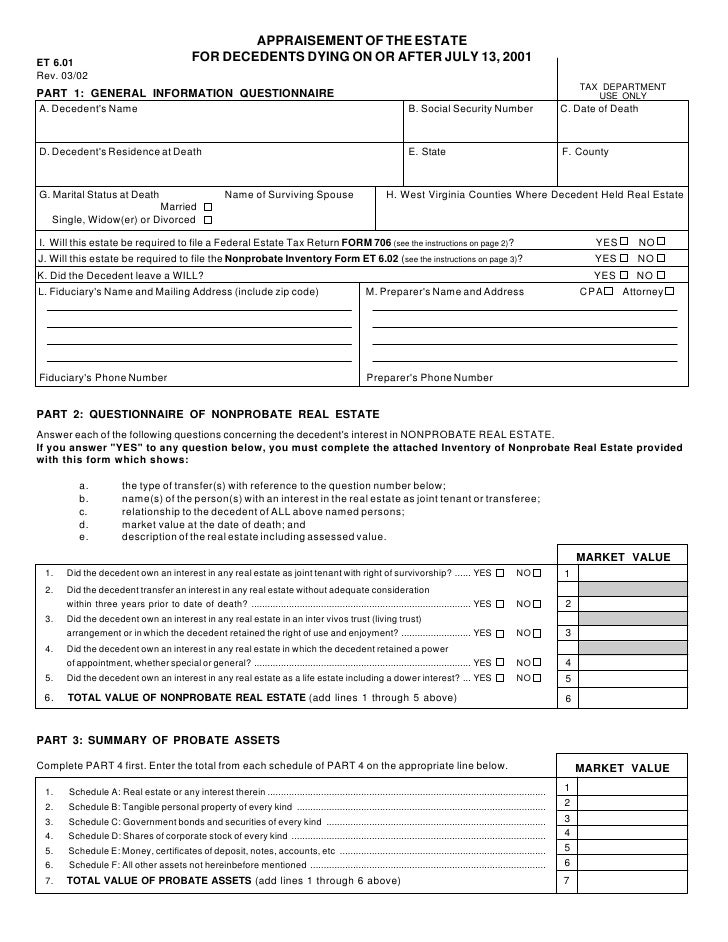

Any estate required to file a Federal Estate Tax Return Form 706 will be required to file a West Virginia Estate Tax Return.

2022 Tax Inflation Adjustments Released By Irs

2012 2022 Form Wv Dor Nrsr Fill Online Printable Fillable Blank Pdffiller

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

Complete Guide To Probate In West Virginia

Biden Is Hiring 87 000 New Irs Agents And They Re Coming For You

What Are The Tax Implications Of Selling A Rental Property Northern Virginia Property Managementnorthern Virginia Property Management

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Form It 141 Download Printable Pdf Or Fill Online West Virginia Fiduciary Income Tax Return For Resident And Non Resident Estates And Trusts 2017 West Virginia Templateroller

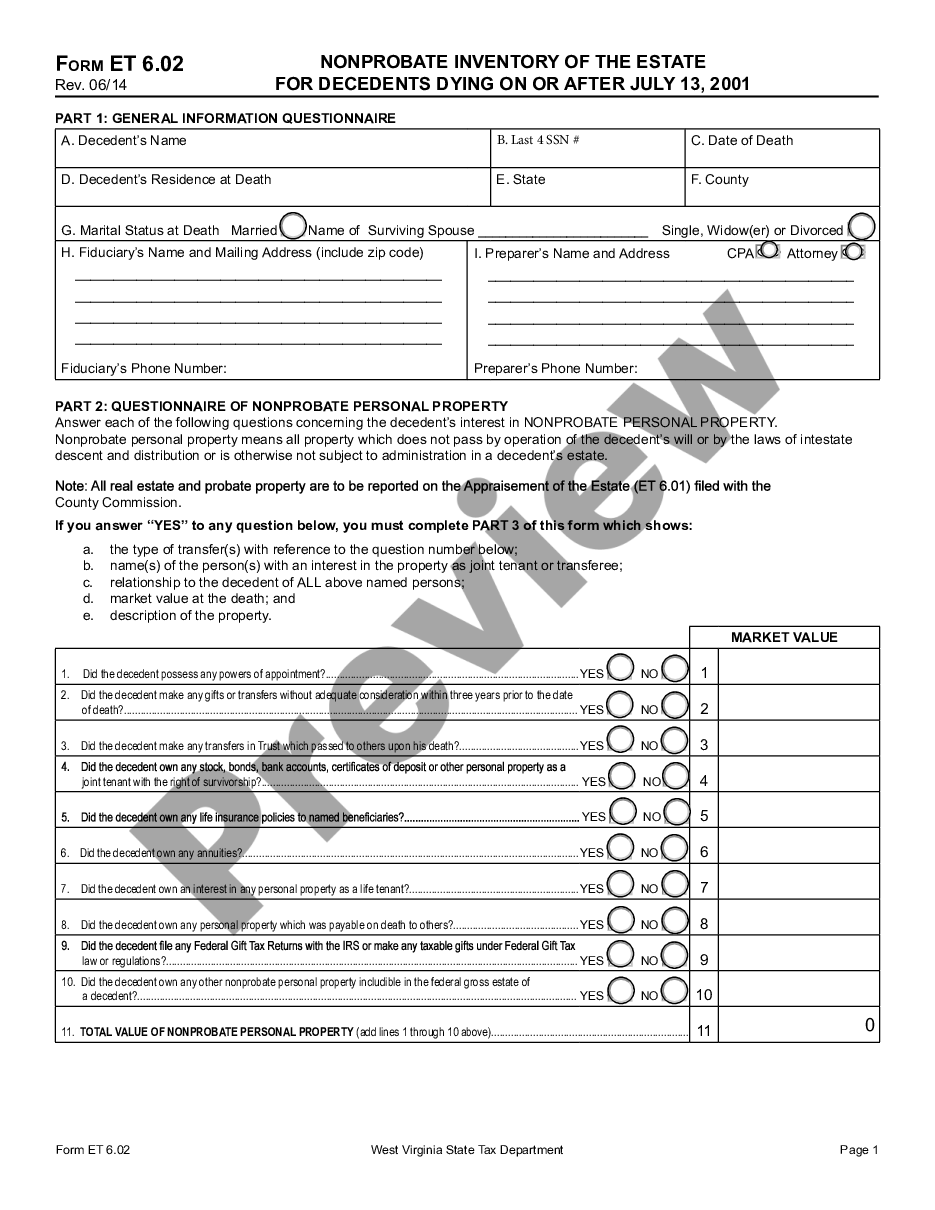

Et601602 State Wv Us Taxrev Taxdoc Tsd

West Virginia Appraisement Of The Estate For Decedents Dying On Or After July 13 2001

Wv State Tax Department Fiduciary Estate Tax Return Forms 2008 Fill Out Sign Online Dochub

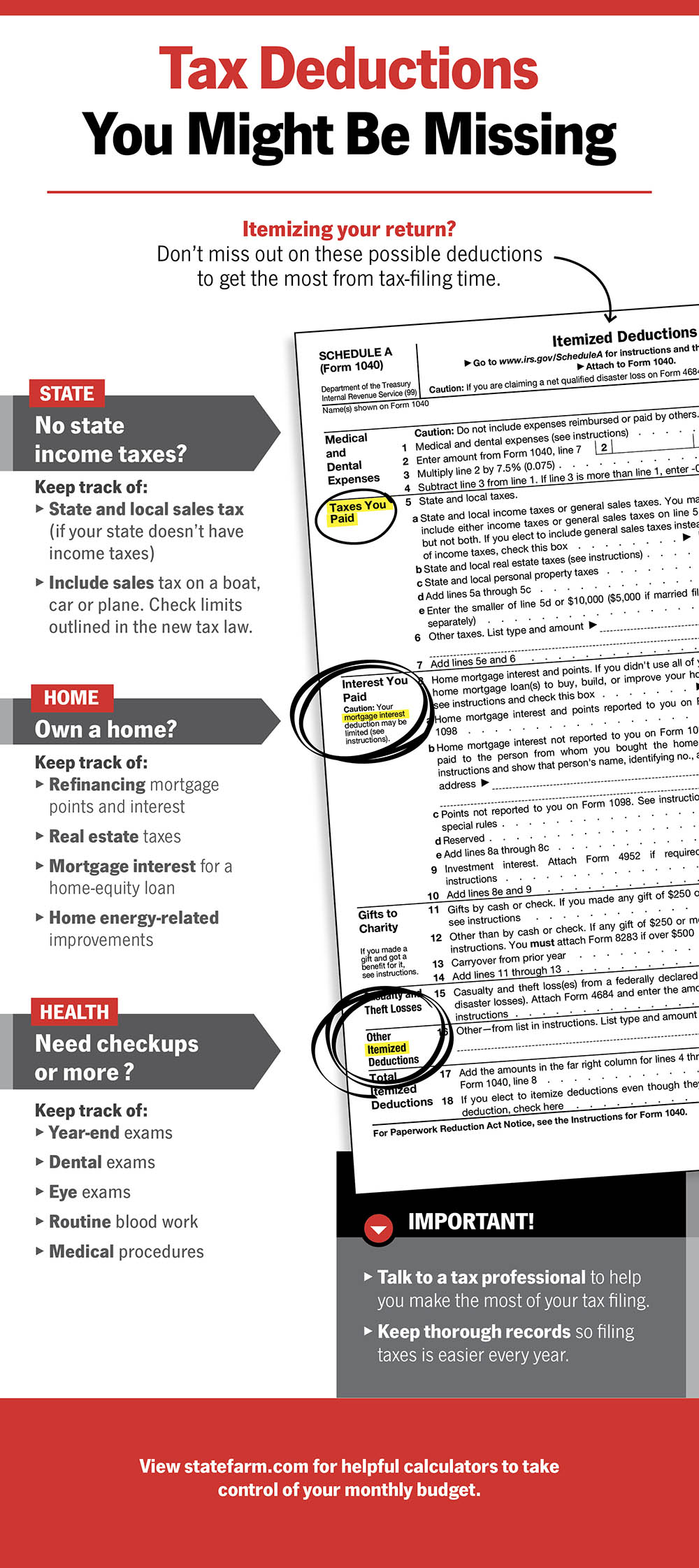

Common Tax Deductions You Might Be Missing State Farm

Free West Virginia Tax Power Of Attorney Form Wv 2848 Pdf Eforms

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Pdf Taxation Of Gifts From Foreign Persons Sandra Spector Academia Edu