does tennessee have inheritance tax

Up to 25 cash back Update. All inheritance are exempt in the State of.

Tennessee Estate Tax Everything You Need To Know Smartasset

IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses.

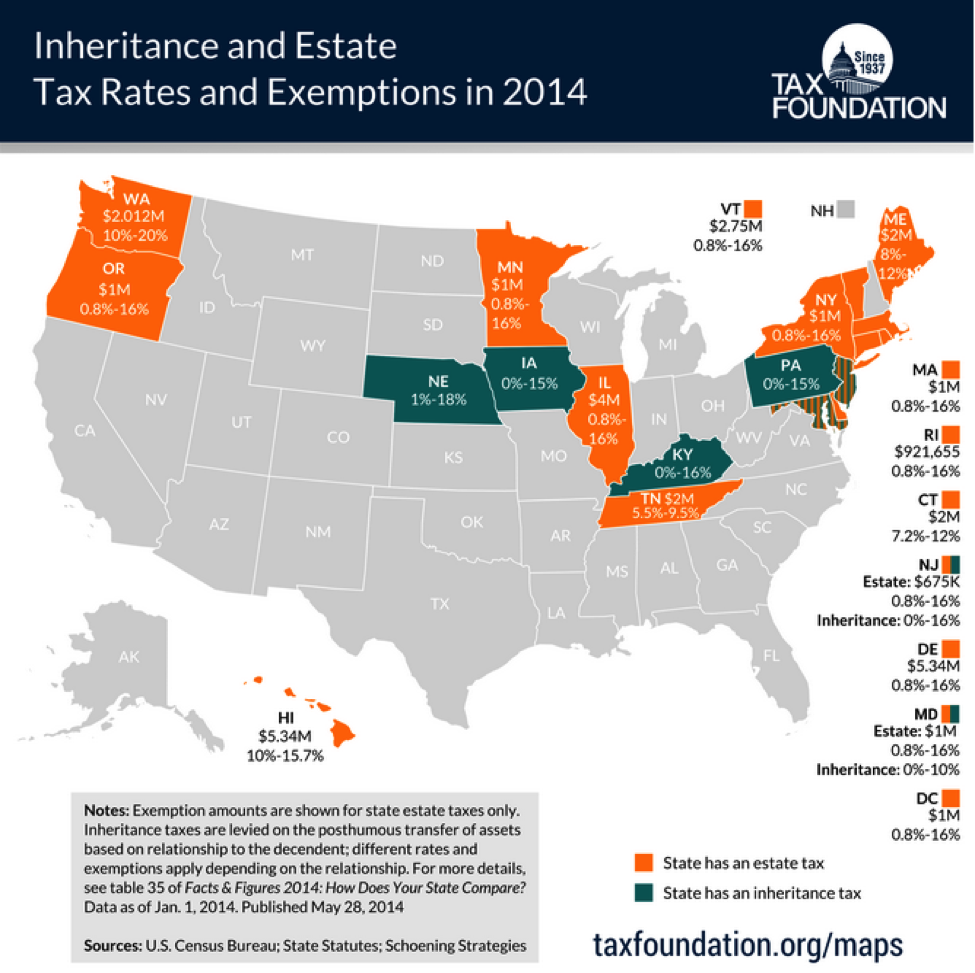

. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. How much is tax free inheritance in Tennessee. Tennessee does not have an inheritance tax either.

Tennessee is an inheritance tax-free state. The net estate less the applicable exemption see the Exemption page is taxed at the following rates. The inheritance tax is levied on an estate.

Those who handle your estate following your death though do have. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to. No tax for decedents dying in 2016 and thereafter.

IT-11 - Inheritance Tax Deductions. It is one of 38 states with no estate tax. For 2021 the exemption in set at 117 million per individual and it is set to increase in.

Inheritance Tax in Tennessee. What is the state of Tennessee inheritance tax rate. Ad Honest Fast Help - A BBB Rated.

The inheritance tax is due nine months after death of the decedent. Even though this is good news its not really that surprising. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015.

It has no inheritance tax nor does it have a gift tax. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. All inheritance are exempt in the State of Tennessee.

There are NO Tennessee Inheritance Tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The estate of a non-resident of Tennessee would not receive the full exemption.

The inheritance tax is no longer imposed after December 31 2015. The net estate is the fair market value of all. Only seven states impose and inheritance tax.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Please DO NOT file for decedents with dates of death in 2016.

What is the state of Tennessee inheritance tax rate. 100 Money Back Guarantee. As of December 31 2015 the inheritance tax was eliminated in Tennessee.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. However there are additional tax returns that heirs and survivors must resolve for their deceased family members. However it does have an estate tax.

Tennessee does not have an estate tax. State Inheritance Tax Return Long Form. As Tennessee does not have an income tax all forms of retirement income are untaxed at the state level.

For deaths occurring in 2016 or later.

Tennessee State Tax Guide Kiplinger

Tennessee Inheritance Laws What You Should Know Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

Graceful Aging Legal Services Pllc Estate Planning Attorney Legal Services Estate Planning

Tennessee Estate Tax Everything You Need To Know Smartasset

Illinois Should Repeal The Death Tax

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Historical Tennessee Tax Policy Information Ballotpedia

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Retirement Income Best Places To Retire

State Estate And Inheritance Taxes Itep

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Is There A Tennessee State Estate Tax Mendelson Law Firm

The Mysterious End Of Tennessee Williams A Truly Bizarre Way To Go In 2022 Tennessee Williams Will And Testament Last Will And Testament

Tennessee Taxes Do Residents Pay Income Tax H R Block

How To Financially Protect Your Unmarried Partner In 2022 How To Plan Estate Planning Common Law Marriage

Cordell Hull Birthplace Museum Good Neighbor Policy Hull Chief Architect

Best Places To Retire In Each State Best Places To Retire Southern Cities Places