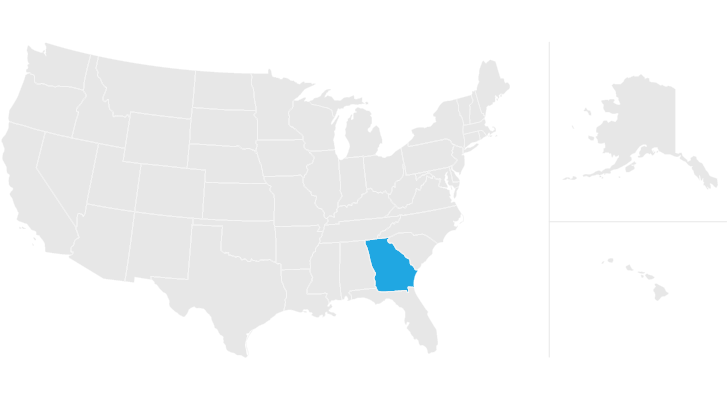

does georgia have an inheritance tax

It is not paid by the. There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current.

Effective Rates Inheritance Tax In Usa 1995 Download Table

Any deaths after July 1.

. No Georgia does not have an inheritance tax. However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning.

These include Pennsylvania Maryland New Jersey. Though Georgia doesnt collect an inheritance tax if you live in Georgia and inherit the property of someone who lived in one of the following states you may have to pay. 60000 for non -domiciled individuals who have been resident in the UK for at least 12 of the previous 14 tax years immediately before the relevant tax year httpswwwgov.

Ad Information You and. Puerto Rico levies estate and gift taxes on the net taxable value. No Georgia does not have an inheritance tax.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. As of July 2014 estates in Georgia no longer have to file estate tax returns or pay estate taxes. Across the state rates range from a low of 045 percent in Fannin County to a high of 166 percent in Taliaferro County.

Georgia Estate Tax and Georgia Inheritance Tax The state. That means that if your husband or wife passes away and leaves you a condo you wont have to pay an inheritance tax. The good news is that Georgia does not have an inheritance tax.

This means that if you pass away in the state of Georgia your beneficiaries will not have to pay any tax on the. Georgia does not assess and inheritance tax or a gift tax. There is the federal estate tax to worry about potentially but the federal estate tax.

No Georgia does not have an inheritance tax. Income tax rates in Georgia do have graduated tax brackets but the tiers are concentrated among the lowest incomes making the. As of 2014 Georgia does not have an estate tax either.

The tax is paid by the estate before any assets are distributed to heirs. How much can you inherit without paying taxes in 2020. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. Posted on Sep 7 2012 Georgia does not have any inheritance tax or estate tax for 2012. Spouses are automatically exempt from inheritance taxes.

However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206. Georgia Has no Inheritance Tax Across the nation there are only six states that have an inheritance tax on their books.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax Probate Advance

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Taxation In Oecd Countries En Oecd

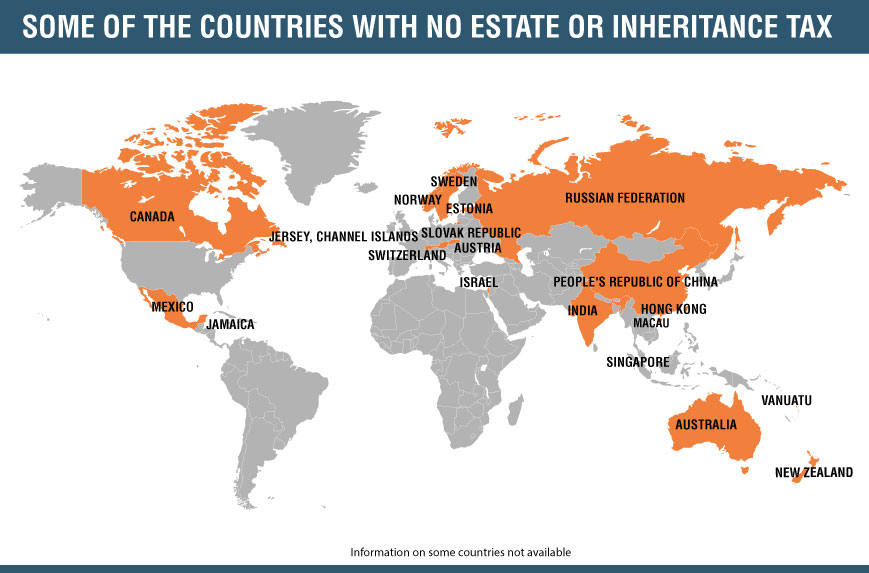

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

What You Need To Know About Georgia Inheritance Tax

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Inheritance Tax Here S Who Pays And In Which States Bankrate

Effective Rates Inheritance Tax In Usa 1995 Download Table

Georgia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wills Attorneys In Savannah Georgia Smith Barid Llc Assist Clients With Ensuring The Smooth Handling Of T Last Will And Testament Will And Testament Mocking

Inheritance Tax Here S Who Pays And In Which States Bankrate

Studies In The Regulation Of Economic Activity A Voluntary Tax New Perspectives On Sophisticated Estate Tax Avoidance Paperback

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group